What’s Going On with AI Stocks?

The AI sector has been a hot topic in the stock market, with companies involved in artificial intelligence experiencing significant fluctuations in their share prices. But what exactly is happening with AI stocks?

The Rise of AI Stocks

In recent years, AI has been hailed as the next major technological revolution. Companies like Nvidia, Alphabet, and Microsoft have heavily invested in AI research and development, leading to remarkable advancements in machine learning, natural language processing, and other AI technologies. This excitement has fuelled a surge in AI share prices, as investors eagerly anticipate the transformative potential of AI across various industries.

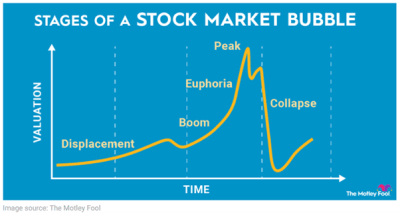

Bubble Concerns

However, this rapid rise has also sparked concerns about a potential AI stock bubble. A stock bubble occurs when the price of shares rises significantly above their intrinsic value, driven by speculative investor behaviour. In the case of AI, the hype and fear of missing out (FOMO) have contributed to inflated valuations. Investors have been pouring money into AI stocks, sometimes without fully understanding the underlying fundamentals.

Recent Market Corrections

Recently, there has been a noticeable sell-off in AI shares, leading some to question whether the bubble has burst. While some analysts believe this is a temporary correction, others warn that the high valuations may not be sustainable in the long term. The volatility in AI share prices highlights the risks associated with speculative investments and the importance of careful market analysis.

The Long-Term Outlook

Despite the recent fluctuations, the long-term outlook for AI remains positive. AI technologies continue to advance, and their applications are expanding across various sectors, from healthcare to finance. Investors should remain cautious but optimistic, focusing on companies with strong fundamentals and realistic growth prospects.

In conclusion, while AI stocks have experienced significant ups and downs, the potential for AI to drive future innovation and economic growth remains strong. As always, informed and strategic investing is key to navigating this dynamic market.

Be more successful with Sidekick. Reach out to our expert team and let’s take your business to the next level!