Smart Choices with Tax Savings

Tax – it’s a dirty word in most households. We know it’s necessary to keep the economy ticking over but jeez it’s painful watching it drain our pay checks. Thankfully, the 2024 budget introduced a bit of respite in the form of an increase in the personal income tax margins, among other things.

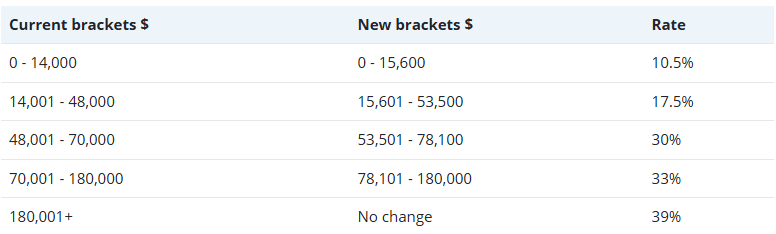

In New Zealand we operate a progressive tax system, meaning that the tax rate increases as your income increases. Unfortunately, the margins at which the tax rates are applied have not been changed since 2010 apart from the introduction of a 39% tax rate for any income earned over $180,000. This means that our old mate inflation has been eating away at your discretionary cash as your income increases and you move up tax brackets.

Budget 2024 has introduced an increase to the income thresholds at which our tax rates are applied. This means that more of your hard-earned cash will stay in your pockets. The new thresholds are outlined below:

The Government’s handy tax calculator is a good start to give you an indication of what impact this will have on your income and tax savings on a fortnightly basis – this can be found here: Tax Calculator – Budget 2024 – 30 May 2024

Once you have plugged in your numbers and realised how many extra coffees your tax savings might buy, hit the pause button. Rather than spending this for a quick endorphin boost could you be smarter with these tax savings? Let’s consider a couple of options that will result in some long-term gains:

- Put that money to work by increasing your KiwiSaver contributions? Squirreling away a little bit more of your pay checks could result in a much more comfortable retirement or potentially an earlier retirement. For those of you saving for your first home, it could also mean that you get your hands on a set of keys a bit quicker.

- If you own a home, consider making extra voluntary contributions towards your mortgage, that way decreasing the term of the lending and get that death pledge paid off quicker! Down the track, you will then have a bit more flexibility around what you do with your pay checks.

- Pay off any high interest debt such as credit cards or personal loans. This might mean that you can then take advantage of options 1 and 2 a bit quicker.

- Invest in yourself – use the savings to take courses, attend workshops, or acquire new skills. This can enhance your earning potential in the long run.

With the cost of living at an all-time high, don’t rely on the Government to bail you out. Take some small steps now to set yourself up for the future.