“Keep on top of your numbers and be proactive with your bank” – Richard Wheeler, Sidekick Timaru

As we face challenging economic conditions, it’s more important than ever for businesses to ensure their financial reporting is up to date. Accurate and timely financial reports are crucial for maintaining a good relationship with your bank, especially when seeking a review of your credit ratings and pricing. Here’s a guide to help you manage this process effectively during these tough times.

The Importance of Accurate Reporting

In the current economic climate, banks are scrutinising financial reports more closely to assess the risk associated with lending. Your financial reports provide a detailed picture of your business’s health, including revenue, expenses, assets, and liabilities. Inaccurate or outdated reports can lead to unfavourable credit ratings, which can result in higher interest rates and less favourable loan terms.

Key Factors Banks Review to Assess Business Credit Ratings

- Financial Statements: Banks closely examine your balance sheet, income statement, and cash flow statement to understand your financial health and stability. This includes historical and forecast viability.

- Payment History: Consistently paying your bills on time is crucial. Late payments can significantly impact your credit score, especially in a tight economy. Electronic payments defaulting on your account due to a lack of available credit can also impact your credit rating.

- Industry Risk: Banks also consider the overall risk associated with your industry. E.g. tourism during lockdown or cattle farming during the M. bovis outbreak.

- Credit Utilisation: This is the ratio of your current credit balances to your credit limits. Lower utilisation rates are generally viewed more favourably.

- Length of Credit History: The longer your business has been operating and maintaining credit, the better. It demonstrates stability and reliability.

- Types of Credit: A mix of credit types (e.g., loans, credit cards, lines of credit) can positively influence your score, showing that you can manage various forms of credit.

- Public Records: Any legal filings such as tax liens, judgements, or bankruptcies can severely impact your credit rating.

Steps to Get Your Reporting Up to Date

- Review and Reconcile Accounts: Make sure all your accounts are current and reconciled. This includes bank accounts, credit cards, and loans.

- Update Financial Statements: Prepare your balance sheet, income statement, and cash flow statement to reflect your current financial status.

- Check for Errors: Review your reports for any discrepancies or errors. Correcting these can prevent potential issues during the bank’s review.

- Maintain Detailed Records: Keep detailed records of all transactions. This helps in accurate reporting and is crucial in case of audits.

- Consult with Your Sidekick: If you’re unsure about any aspect of your financial reporting, consult with your Sidekick accountant. They can provide valuable insights and ensure everything is in order, as well as prepare annual and management reports.

Managing Economic Challenges

Given the current economic challenges, it’s essential to be proactive in managing your finances. Here are some additional tips:

- Cash Flow Management and Forecasting: Monitor your cash flow closely and look for ways to improve it. This might include negotiating better payment terms with suppliers or finding ways to reduce expenses.

- Cost Control: Identify areas where you can cut costs without compromising the quality of your products or services.

- Diversify Revenue Streams: Explore new markets or products to diversify your revenue streams and reduce dependency on a single source of income.

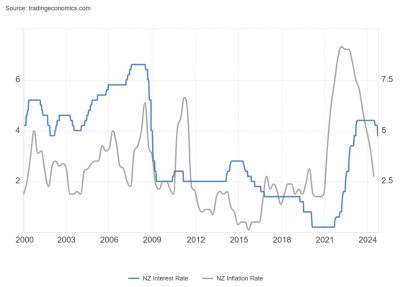

Recent Interest Rate Trends

Understanding current interest rate trends can help you anticipate changes in loan pricing. As of October 2024, the Reserve Bank of New Zealand has trimmed the official cash rate to 4.75%, marking the second cut since March 2020 totaling 0.75%. This decision was influenced by a slowdown in the annual inflation rate to 2.2% in the third quarter of 2024. Most Banks are expecting the OCR to reduce by a further 0.50% in November. Regular monitoring of both floating and fixed rate trends by communicating with your bank will mean you are not late to the party.

By keeping your financial reporting up to date and understanding the factors that affect your credit rating, you can better navigate these tough economic conditions. Stay proactive and consult with your Sidekick to manage these complexities effectively.

Feel free to reach out if you have any questions or need further assistance with your financial reporting. We’re here to help!