Cashflow is King

What is the difference between profit and cashflow?

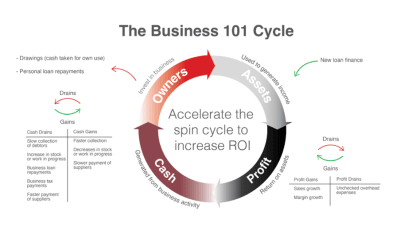

The Business 101 Cycle is a great tool to help you understand the difference between profit and cashflow. The first step in the cycle is for you, as the owners, to invest money into the business to purchase assets. You might need additional finance to help fund these.

You then use the assets to generate a profit. To increase your profit, you could increase sales or improve your margins. On the other hand, drains on profit can include unchecked overhead expenses and wastage.

You then turn that profit into cash. Drains on cash include the slow collection of debtors, increase in stock or work in progress, loan repayments, tax payments, and faster payment of suppliers. To improve the amount of cash you have, you can collect your debtors faster, decrease your stock or work in progress, negotiate longer payment terms with suppliers, reduce tax payable, and refinance loans.

Then, you need to decide how much of that cash you want to take out of the business for your personal expenditure. The balance is then available to reinvest in the business. The goal is to accelerate this cycle as fast as we can to improve your return on investment.

The Cash Conversion Cycle

The Cash Conversion Cycle shows how long your cash is tied up in stock or work in progress. The shorter your cycle is, the better, as your cash will hit the bank sooner.

We can help you to calculate your cash conversion cycle, get in touch.